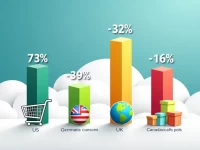

Amazon US Marketplace Attracts New Sellers With Early Sales Success

Amazon's U.S. market offers new sellers the best entry opportunity with a 73% success rate for first sales and a large user traffic. The U.S. market shows a high acceptance for niche products, and the advantages of a mature ecosystem enable new sellers to conduct business more smoothly and achieve rapid sales growth.